With tariffs threatening to slow the economy and induce some unpleasant adjustments, the aroma of recession is permeating the air. Economists seem to be increasing the likelihood of a recession almost every day. There are a number of concerning indicators that have surfaced; some may be false alarms, while others may portend a future downturn.

If the economy continues to decline, you may see more “for sale” signs being up for longer on houses in your neighborhood, more homeless encampments popping up, and more liquidations of businesses. These factors, however, have been present even during prosperous times and are not one of the few early warning signs that economists follow.

Filing for bankruptcy is occasionally an accurate predictor of an impending recession. Recessions are known to boost filings, but this trend has persisted for the previous three years. In a more significant turn of events, LegalShield anticipates “a potential wave” of bankruptcy filings this summer based on consumer inquiries about bankruptcy, which reached a record high in the first quarter of 2025.

So, how can economists foretell when a recession will occur? A nonprofit organization that studies business trends, the Conference Board, has put together an index of leading economic indicators that contains a wealth of important information. Several of the ten variables that make up this index had been declining before President Trump unveiled his stricter tariff agenda in early April.

The U.S. unemployment rate stood at 4.2% in March, and 4.1% in Arizona. Those numbers aren’t bad, but jobless rates aren’t a leading indicator for predicting the direction of the economy. After the economy starts to sour, they will start climbing.

To measure the jobs picture on a more real-time basis, the Conference Board tracks average weekly initial claims for unemployment insurance, which were slightly negative as of February. Few metro-Phoenix employers have issued big layoff announcements in recent months, but that could change quickly if the economy weakens.

Credit and interest-rate movements

The Conference Board compiles a credit index and tracks the spread or difference between yields on 10-year Treasury bonds minus the federal funds rate. These indicators are somewhat complex and, as of the report published in March, they were flashing mixed signals, with no strong trend apparent.

If a recession materializes, the normal pattern would be for interest rates to ease. But with inflation expectations also rising, owing largely to higher tariffs, the Federal Reserve could face a tough choice between trying to boost economic activity while trying to keep inflation at bay.

During periods of economic weakness when lending activity slows, consumers with high credit scores sometimes can take advantage of attractive offers. For example, NerdWallet recently highlighted a limited-time sign-up bonus of 100,000 reward points on the Chase Sapphire Preferred Card after customers use it to spend at least $5,000 over three months. That’s up from a prior 60,000-point offer.

Consumer sentiment and expectations

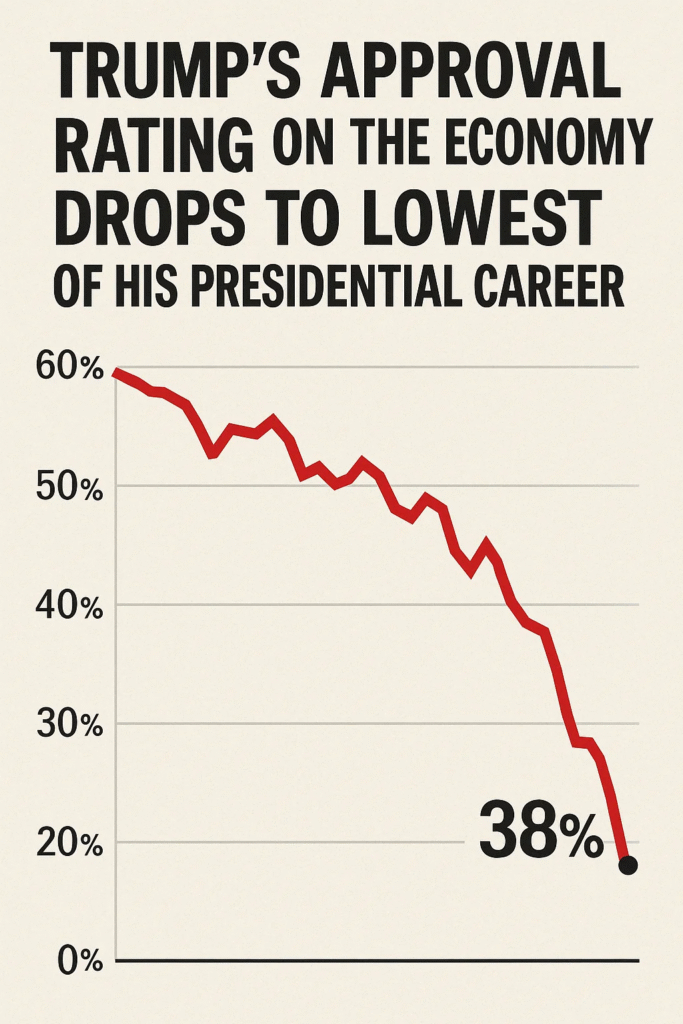

Americans are feeling uneasy about the economy, and that is showing up in the data.

Even before Trump’s tariff announcements, consumer expectations were the component that weighed down the leading indicators index most heavily as of the Conference Board’s March report.