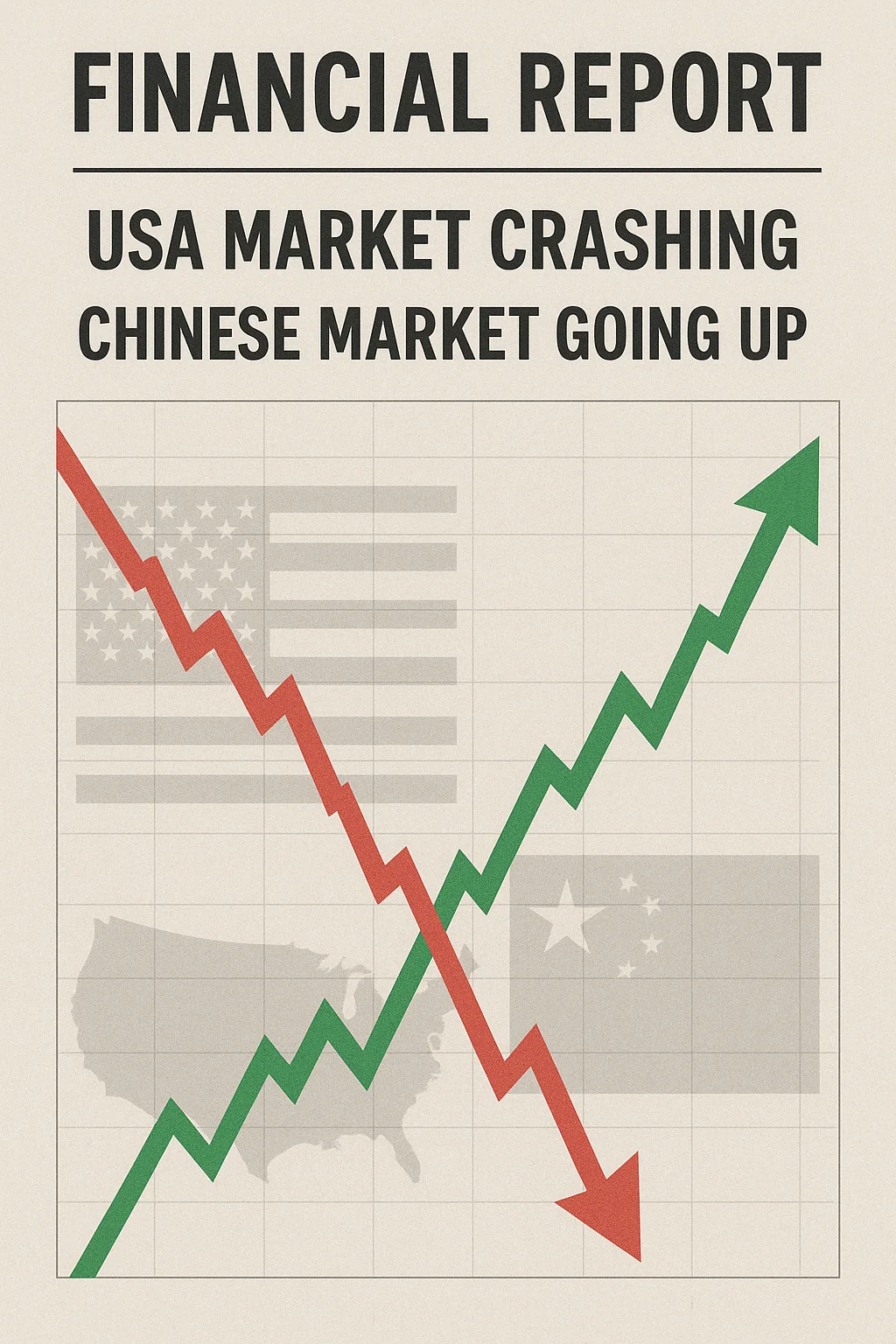

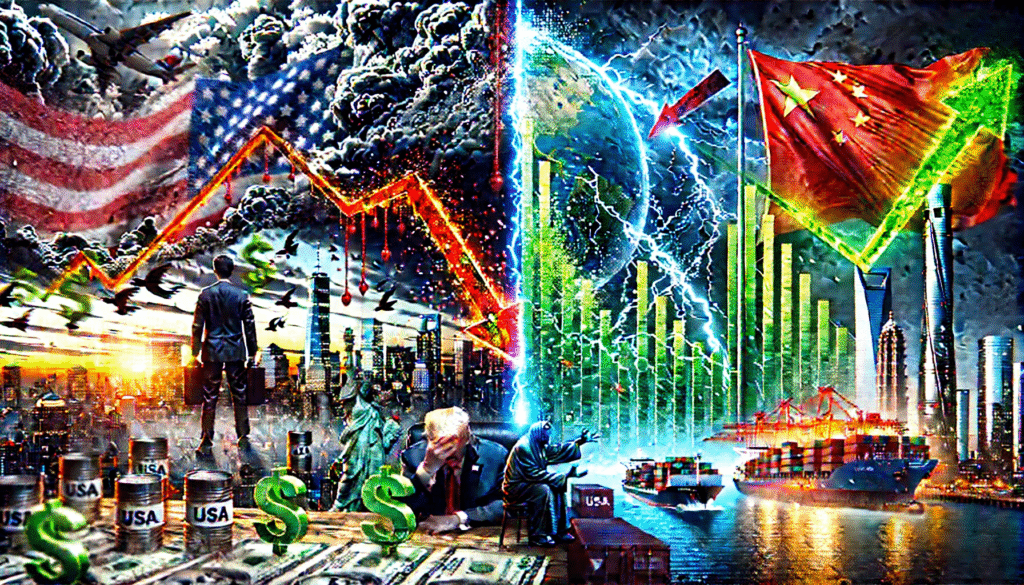

Overview: The financial markets in the USA are experiencing a significant downturn, with stocks and key indices plummeting as a result of multiple factors, including political uncertainty, sluggish economic growth, and ongoing trade tensions.

Meanwhile, the Chinese market is experiencing a sharp upward trend, driven by a series of positive economic indicators and increasing investor confidence in China’s market recovery. This report explores the key drivers behind these contrasting movements in the markets and the implications for global investors.

USA Market: Reasons for the Downturn The U.S. market is facing a considerable decline, with several key factors contributing to the crash:

- Political Uncertainty:

Ongoing political gridlock in Washington D.C. has led to a lack of progress on critical economic policies, including trade agreements and tax reforms. The uncertainty regarding the government’s ability to address economic challenges has eroded investor confidence. - Interest Rate Hikes:

The Federal Reserve has raised interest rates multiple times in an effort to combat inflation. While this move aims to stabilize the economy, it has had the unintended effect of increasing borrowing costs for businesses and consumers, resulting in reduced spending and investment. - Trade Tensions:

The U.S. continues to face trade challenges with major partners, particularly China. Despite attempts to negotiate trade agreements, there has been little progress, creating further uncertainty in the market. The threat of additional tariffs has exacerbated market volatility. - Weak Economic Indicators:

Recent economic data, including GDP growth figures and employment statistics, have shown signs of stagnation. With inflation remaining above target and consumer confidence waning, economic growth has slowed, further contributing to market declines.

Chinese Market: Reasons for the Upward Trend In contrast to the U.S., the Chinese market is experiencing a robust rally. Several key factors have contributed to the market’s positive performance:

- Economic Recovery:

China’s economy is showing signs of recovery, with stronger-than-expected GDP growth driven by increased manufacturing output, a rise in exports, and government stimulus initiatives aimed at supporting economic activity. - Positive Trade Developments:

China’s government has successfully negotiated several trade agreements with both emerging and developed markets, reducing tariff barriers and increasing trade flows. These agreements have boosted investor confidence in the long-term growth prospects of the Chinese market. - Government Support:

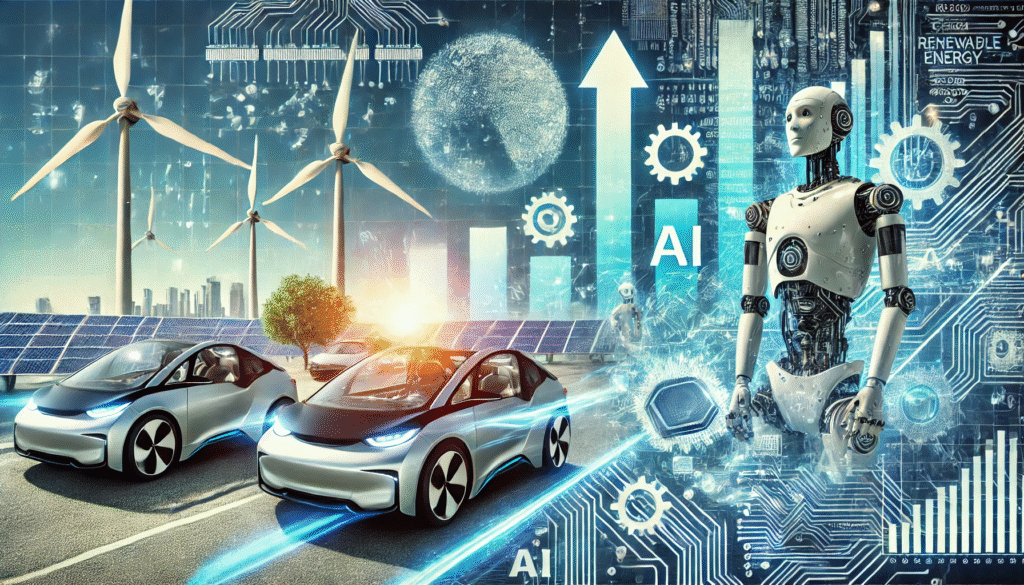

The Chinese government has implemented a series of fiscal and monetary policies designed to stimulate economic growth, including infrastructure spending and reduced interest rates. These actions have helped to drive up stock prices and improve market sentiment. - Technology and Innovation Boom:

China’s technology sector, especially in areas such as electric vehicles, renewable energy, and AI, has seen rapid growth. Chinese companies in these sectors are receiving significant investment, further fueling the upward momentum in the market.

Implications for Global Investors: The divergence between the U.S. and Chinese markets presents an intriguing opportunity for global investors. While the U.S. market is facing challenges, including increased volatility and uncertainty, the Chinese market appears to be a bright spot for those seeking growth.

- Opportunities in China: Investors looking for exposure to global growth may consider increasing their allocations to Chinese stocks, especially in sectors poised for long-term growth, such as technology, renewable energy, and consumer goods.

- Caution in U.S. Markets: The U.S. market may be a riskier investment in the short term. However, sectors such as technology, healthcare, and consumer staples could provide defensive positions for investors seeking to weather the downturn.

- Diversification: This situation underscores the importance of a diversified global portfolio. Investors should be mindful of the risks associated with relying too heavily on any one market and consider exposure to markets with differing economic cycles.

Conclusion: The USA market is facing significant challenges due to political uncertainty, trade tensions, and economic stagnation, while the Chinese market is experiencing an upward surge driven by strong economic recovery, government support, and positive trade developments.

Investors should remain agile and consider diversifying their portfolios to take advantage of the growth opportunities in China, while managing risks in the U.S. market.