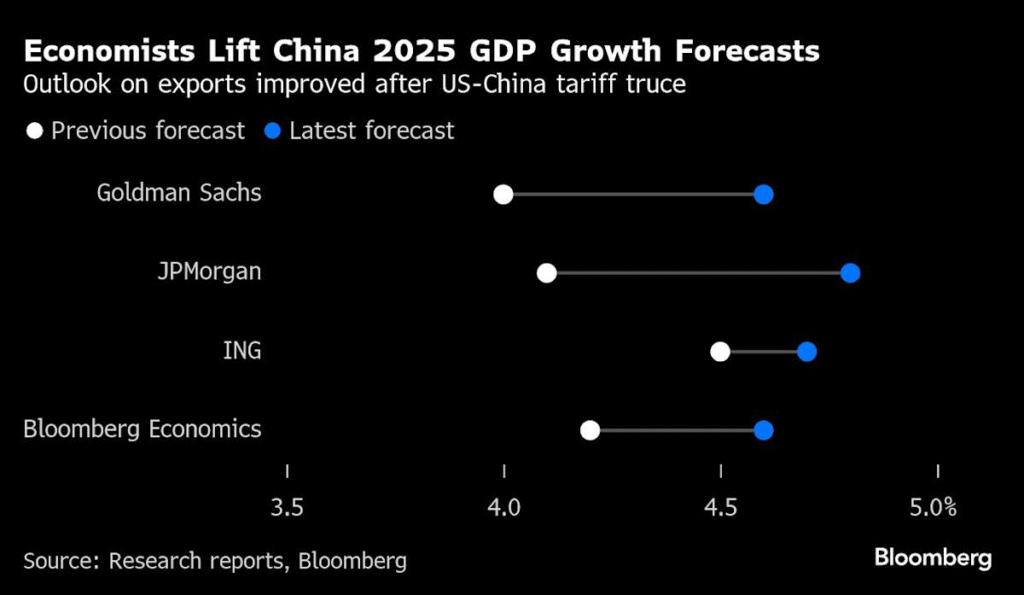

With tariff reductions signalling a de-escalation of trade tensions between China and the United States, investment banks are upgrading their economic growth forecasts for both countries.

Goldman Sachs raised its forecast for China’s real gross domestic product growth this year to 4.6 per cent, up from 4 per cent. It also upgraded its US economic growth forecast by half a percentage point to 1 per cent and trimmed the odds of a recession in the US in the next 12 months by 10 percentage points to 35 per cent.

The Wall Street investment bank also raised its expectations for the yuan’s exchange rate against the US dollar. It now expects the rate to reach 7.20 in three months, 7.10 in six months, and 7.00 in 12 months, compared with previous forecasts of 7.30, 7.35 and 7.35, respectively.

“The negotiations are unlikely to be straightforward given the substantial trade imbalance, but the strength of China’s export sector and the undervalued levels of the currency … all point to the possibility for a stronger yuan as a potential offset to tariff reductions,” Goldman Sachs analysts said in a research note issued on Tuesday.

UBS raised its forecast for China’s real GDP growth this year to between 3.7 per cent and 4 per cent – depending on the ultimate form of additional US tariffs on Chinese goods and the scale of policy stimulus implemented by Beijing – up from 3.4 per cent previously.

“The trade war de-escalation may lead to a smaller shock on China’s exports and economic growth, as well as more modest additional policy stimulus in the rest of 2025,” Wang Tao, the head of Asia economics and chief China economist at the Swiss bank, said on Tuesday.

Robin Xing, chief China economist at Morgan Stanley, said in a research note issued on Monday that China’s GDP growth in the second quarter could be better than the investment bank’s current estimate of around 4.5 per cent year on year.

He said economic growth in the third quarter might stay steady at over 4 per cent, instead of dropping to around 4 per cent as previously forecast.

“The tariff pause offers a reprieve from what had begun to resemble a bilateral trade embargo. While tariffs remain elevated, the suspension window could lead to front-loaded shipments and production,” Xing said, adding that the complexities of the bilateral relationship meant that finding a durable resolution remained a challenge.

JP Morgan upgraded its China GDP growth forecast for the year to 4.8 per cent on Monday, up from 4.1 per cent, saying that the lower tariff rates would boost China’s GDP by around 1.5 percentage points if they were maintained throughout the year.

On Tuesday, Barclays predicted US GDP growth of between 0.5 per cent and 1 per cent over the next three quarters. After US President Donald Trump’s “Liberation Day” announcement of increased tariffs on all of America’s trade partners on April 2, it had previously forecast that the US economy would enter a mild recession in the second half of the year.

After talks in Switzerland over the weekend, China and the US agreed to ease the sky-high tariffs imposed on each other’s products last month.

The US will cut its duties on Chinese imports from 145 per cent to 30 per cent for the next 90 days, while China will reduce its levies on American goods from 125 per cent to 10 per cent.

While estimating that US tariffs of 30 per cent would shave off 1 percentage point off China’s GDP growth this year, Larry Hu, chief China economist at Macquarie, said he expected that China would still hit its growth target of around 5 per cent this year by using stimulus to offset tariffs.

“Beijing will announce stimulus in a reactive way, because it doesn’t want to miss the target, but also doesn’t want to overachieve it,” Hu wrote in a research note issued on Monday.

China rolled out a supportive policy package last week to shore up the economy and stabilise the market, including plans to cut interest rates and banks’ required reserve ratios, and ramp up support for consumers and businesses affected by US tariffs.

Chinese exports rose by 8.1 per cent year on year in April, despite the US tariff increases that came into effect early in the month, compared with 12.4 per cent growth in March.