As President Trump continually attacked Federal Reserve chairman Jerome Powell, key Wall Street indices dropped to one-week lows. The US dollar also dropped since both US and China seem to be ready to keep battling their trade spat.

Monday’s US stocks dropped after US President Donald Trump reiterated his criticism of Federal Reserve Chair Jerome Powell, so raising investors’ concerns regarding the central bank’s autonomy and ability to control inflation.

Powell has been chosen by Trump to lead the Federal Reserve starting January 2017. Four years later, Powell was nominated by Joe Biden as well. Powell’s term right now runs until 2026.

Trump asked Powell last week to lower interest rates to boost US economy. The US president attacked Powell, then on Monday he reaffirmed his criticism on social media warning of an economic downturn until “Mr. Too Late, a- major loser, lowers interest rates.”

Days before Trump’s outburst, an official from the White House adviser said the Trump government could look at measures to discredit Powell.

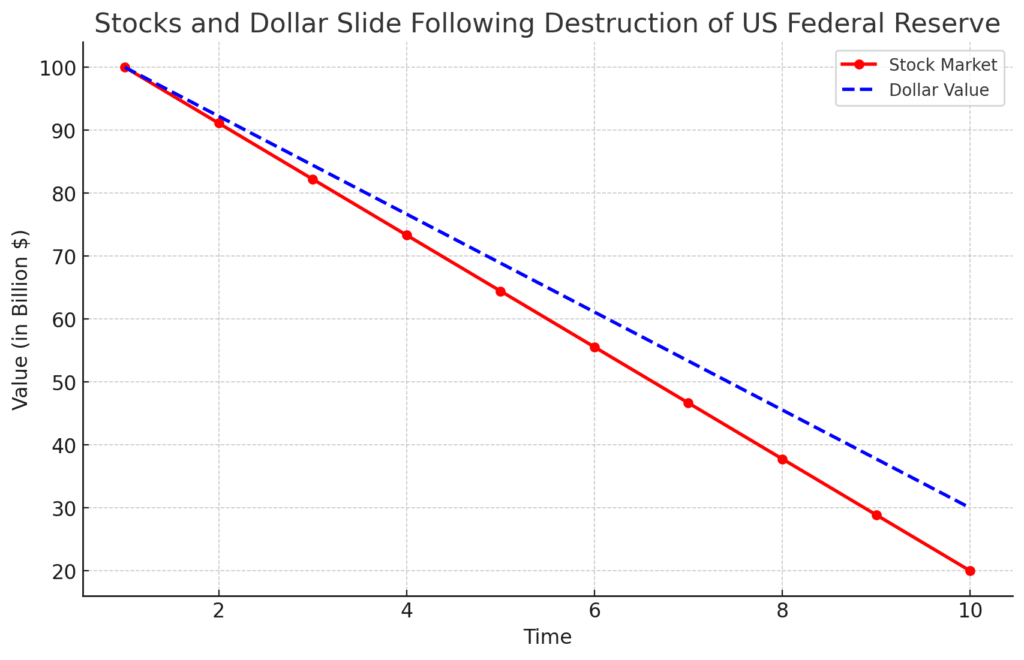

With S&P 500 declining 3.1 percent while the Dow Jones Industrial Average down 2.9 percent at 1.30 p.m. Eastern time, Wall Street appears to be impacted by uncertainty.

With some of the largest losses, “Big Tech” firms like Tesla from Elon Musk drove the Nasdaq composite to a record 3.4 percent.

“Markets are displaying displeasure of a lack of progress on trade negotiations,” said Jamie Cox, Richmond, Virginia managing partner of Harris Financial Group.

“Investors are worried about Fed independence,” Chicago-based Cresset Capital’s chief investment officer, Jack Ablin, told Reuters. “We will see a continuation of what we are now experiencing if the president places his own person in and lowers rates against a backdrop of increasing inflation.”

The value of the US dollar was also declining due of the uncertainty surrounding the tariffs imposed by Trump on imports from overseas and as of yet, the promise of new trade agreements as international investors retreated more and more away from US markets.