Japan’s private sector PMIs for April, on Wednesday, April 23, will spotlight the USD/JPY pair and the Bank of Japan after a choppy Tuesday session.

Economists expect the Jibun Bank Manufacturing PMI to fall from 48.4 in March to 47.8 in April and the Services PMI to drop from 50 to 49.7 in April. April’s survey will likely reflect the early effects of tariffs on demand for Japanese goods and services sector activity.

- Japan’s April Services PMI forecast at 49.7 may fuel BoJ rate pause bets and influence USD/JPY sentiment.

- USD/JPY eyes 145 if Japan Services PMI weakens and Fed signals support the dollar on strong US data.

- AUD/USD gains as Australia’s PMIs beat forecasts amid easing US-China trade tensions.

Given Japan’s services sector contributes around 70% to GDP, a drop below the neutral 50 could raise recession concerns. A weakening economic backdrop may temper bets in an H1 2025 Bank of Japan rate hike and dampen Yen demand. However, an unexpected rise in service sector activity could drive Japanese Yen demand, bolstered by a more hawkish BoJ stance.

USD/JPY: Key Scenarios to Watch

Safe-haven flows into the Yen could weigh on USD/JPY, while improved risk sentiment may provide support.

- Bullish Yen Scenario: Escalation in the US-China trade war, upbeat Japan Services PMI, risk-off sentiment, or hawkish BoJ rhetoric—may pull USD/JPY lower toward the 140.309 support.

- Bearish Yen Scenario: Easing US-China tensions, a weaker Japan Services PMI, or dovish BoJ signals—could lift the pair toward 145.

USD/JPY Daily Outlook: PMIs and the Fed in Focus

Later in the US session, US private sector PMI data also requires consideration. Given the services sector contributes around 80% to the US GDP, the S&P Global Services PMI will be the focal point. Economists forecast the Services PMI to fall from 54.4 in March to 52.8 in April.

A weaker-than-expected PMI may revive US recession fears, supporting a more dovish Fed stance. In this scenario, the USD/JPY pair may drop toward 140. Conversely, an unexpected pickup in services sector activity may sink bets on a June Fed rate cut, potentially sending the pair toward 145.

Beyond the data, Fed commentary and tariff-related news will also influence USD/JPY trends.

Potential USD/JPY Moves:

- Bullish US dollar Scenario: Easing trade tensions, upbeat US services sector data, or hawkish Fed rhetoric could drive USD/JPY toward 145.

- Bearish US dollar Scenario: Renewed tariff threats, a weaker US Services PMI, or dovish Fed commentary may push the pair toward the 140.309 support level.

AUD/USD Outlook: PMIs Beat Forecasts

Australia’s private sector PMIs beat forecasts on April 23, signaling underlying economic strength and lending support to AUD/USD.

The Judo Bank Manufacturing PMI fell from 52.1 in March to 51.7 in April, while the Services PMI slipped from 51.6 to 51.4 in April.

According to the April survey:

- New business rose at the most marked pace in three years, boosted by domestic demand as tariffs hit overseas orders.

- Firms increased staffing levels to meet rising demand.

- Higher wage, material, and energy prices sent input prices higher, though service sector cost inflation crucially limited the increase.

- Manufacturers hiked selling prices at the fastest pace in over two years, pushing output price inflation higher.

The combination of resilient growth, a tighter labor market, and rising inflation may temper bets on an RBA rate cut in May.

AUD/USD: Market-Moving Factors

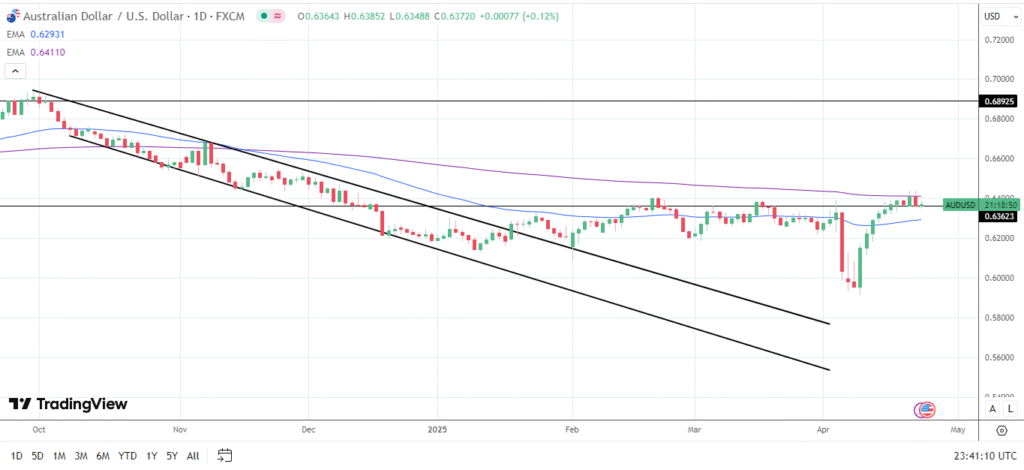

- Bullish Aussie dollar Scenario: A de-escalation in US-China trade tensions or hawkish RBA rhetoric may push the AUD/USD pair above the 200-day Exponential Moving Average (EMA), targeting $0.65.

- Bearish Aussie dollar Scenario: Renewed tariff threats or dovish RBA signals could pull the pair below the $0.63623 support level. A drop below $0.63623 may potentially test the 50-day EMA.

For a comprehensive analysis of AUD/USD trends and trade data insights, see our top trading signals for AUD/USD amid tariff tensions here.

Aussie Dollar Daily Outlook: PMIs and Fed Speakers in Focus

In the US session, PMI results and Fed commentary will influence US-Aussie interest rate differentials. Weaker-than-expected US private sector PMI data may boost Fed rate cut bets, narrowing the rate differential. In this scenario, the AUD/USD pair may climb above the 200-day EMA and target $0.65.

On the other hand, upbeat PMI data and Fed calls to delay rate cuts may widen the rate differential. A wider differential could pull the pair below the $0.6323 support level and potentially sub-$0.63.

Key Market Drivers to Watch Today:

- USD/JPY: US-Japan trade dynamics and BoJ signals.

- USD/JPY and AUD/USD: US PMI results, Fed commentary, and tariff updates.

- AUD/USD: RBA comments and Chinese stimulus developments.