- European stock markets have moved narrowly into the green as investors parse a flurry of earnings.

- Aerospace and defense stocks have been given a boost by a German minister’s comments on NATO spending commitments.

- Shares of German industrial giant Thyssenkrupp are meanwhile down nearly 12% after its results disappointed.

- Data showed the U.K. economy grew by an unexpectedly strong 0.7% in the fourth quarter. The print will be welcomed by Finance Minister Rachel Reeves, but economists warn the momentum may not last.

- And an EU official tells CNBC’s Silvia Amaro that negotiations with the U.K. are moving at a “very slow pace” and have met “two major stumbling blocks.” EU and U.K. representatives meet for a summit on resetting post-Brexit relations next week, with trade, aid and defense on the table.

Earnings roundup

It’s been a busy day for corporate earnings releases. Here’s a roundup of some of the European companies that have reported on Thursday:

Allianz: The German insurer posted record operating profit for the first quarter of the year, with the figure jumping 6.3% year-on-year to 4.2 billion euros ($4.7 billion). The company confirmed its full-year guidance.

Thyssenkrupp: Thyssenkrupp noted a 6% year-on-year drop in orders in its fiscal second quarter, while sales were down 5% from the previous year. Adjusted earnings before interest and taxes (EBIT) fell 90% year-on-year to 19 million euros.

Aviva: Britain’s Aviva reported a 9% annual jump in general insurance premiums in the first quarter of 2025, coming in at £2.9 billion.

Siemens: The German group’s quarterly sales totaled 19.8 billion euros, beating analyst expectations of 19.2 billion euros. Siemens also hauled in 2.4 billion euros in net profit, beating a forecast of 1.85 billion euros.

Merck: The German pharmaceutical firm cut its full-year outlook amid macroeconomic and geopolitical uncertainty and foreign-exchange headwinds. The company forecast earnings before interest, tax, depreciation and amortization (EBITDA), adjusted for one-off items, of around 5.8 billion to 6.4 billion euros in 2025. That’s below the 6.1 billion euros to 6.6 billion euros forecast in February.

Deutsche Telekom: Reported a 6.5% year-on-year rise in first quarter net revenue, which came in at 29.8 billion euros for the three months to March. Adjusted EBITDA after leases rose 7.9% as free cash flow soared by 52.4%.

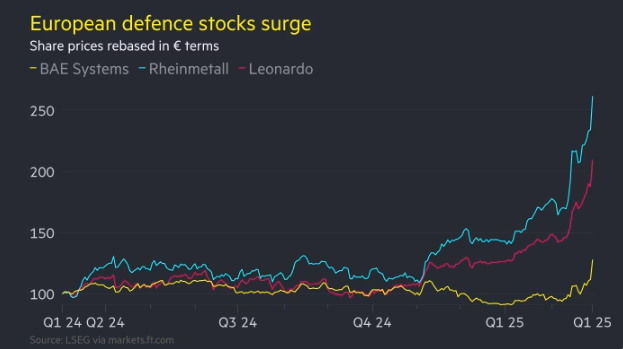

Aerospace and defense stocks are higher

The European Stoxx 600 Aerospace and Defense index is up 1.58% as we hit midday in London, pulling above most other sectors. Germany’s Hensoldt is among the top movers, up 6.4%.

Investors may be looking to comments by German Foreign Minister Johann Wadephul, who has backed U.S. President Donald Trump’s call for NATO members to up their defense spending targets to 5% of their individual GDP.

Oil prices fall 4% after Trump raises hopes of a U.S.-Iran nuclear deal

CNBC’s Sam Meredith is reporting on falling oil prices, which come amid expectations that the U.S. and Iran could make a nuclear deal.

Benchmark Brent crude futures for July delivery were edging toward a 4% drop at around 10:20 a.m. in London.